What are Estimated Quarterly Taxes?

Taxes are a pay-as-you-go system. For people who are self-employed, the government requires taxes to be paid at least four times per year (thus “quarterly” taxes). Quarterly taxes include all taxes owed (income tax, self-employment tax). There is no limit to how frequently one can pay estimated quarterly taxes. You can make payments online by setting up an eftps.gov (check out our YouTube video here), or by going to https://www.irs.gov/payments, and clicking one of the “Pay Your Taxes Now” options.

Who has to Pay Quarterly Taxes?

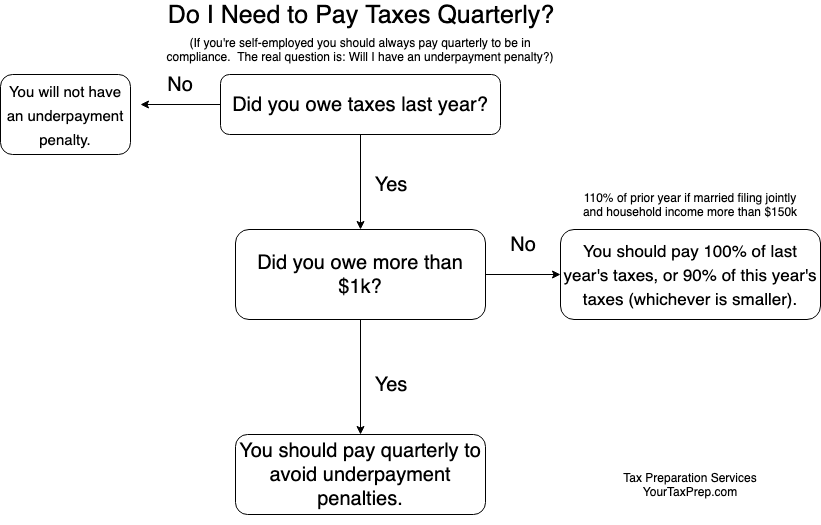

If a picture is worth a thousand words, how about a flowchart:

Hopefully the flowchart is pretty self-explanatory. If you owed (had to pay) taxes the previous year, you need to pay quarterly taxes (how much you have to pay depends on how much you owed the previous year). If you received a refund last year, you won’t have an underpayment penalty.

Other Payment Options

If you are a standard W2 employee and have some self-employment endeavors on the side, there are additional options available to you. You can adjust your withholdings (form W4) at you 9-5 job to cover taxes you may owe. One great thing about being a W2 employee is that your employer deals with paying all the taxes on your behalf and they follow the pay-as-you-go IRS mandates. Win-win! If you need help adjusting your withholdings or calculating your self-employment taxes, you can check out another one of our videos here. You can always contact us through our website.

Contact Us

Questions, comments? I’m always available by email. Send me a message at Chad@YourTaxPrep.com. You can also use the contact form on our contact page. We’re happy to hear questions and suggestions for future material. If there’s a tax topic that interests you, let us know!

Recent Comments